Plan your spending: the best (and worst) months to buy revealed

PriceSpy

PriceSpy

Updated: 29 March 2023

PriceSpy

PriceSpy

Updated: 29 March 2023

With consumers continuing to face interest rate rises, a cost-of-living crisis and surging food prices, many may be looking to tighten their spending across 2023.

To help consumers plan their purchases more carefully, PriceSpy, has researched the best (and worst) times to buy consumer goods across over 30 different shopping categories listed on the fully impartial price and product comparison site*.

Key research findings:

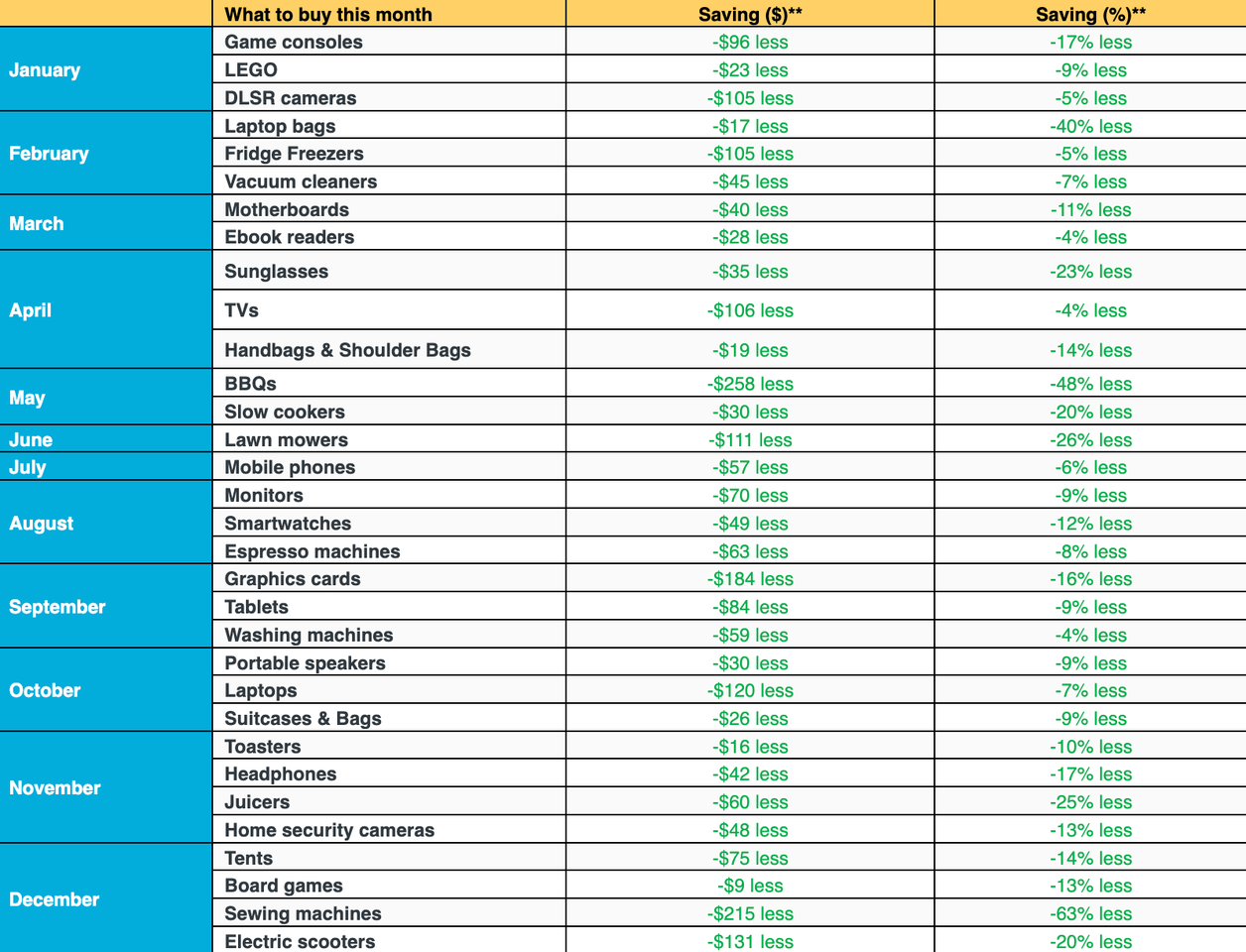

Dependent on the month of the year consumers purchased, PriceSpy’s research revealed considerable savings can be easily made:

PriceSpy’s research also uncovered how further savings could be made by regularly monitoring price points across the year, not buying products as soon as they have been released and buying out of season. For example:

Liisa Matinvesi-Bassett, New Zealand country manager for PriceSpy, says: “Some purchases are a luxury, whilst others are a necessity. Whatever the motivation for buying, our new research aims to help people buy the right product at the right time, so that they can plan their spending accordingly and enjoy the potential savings on more important things.

PriceSpy Guide - The best times to buy

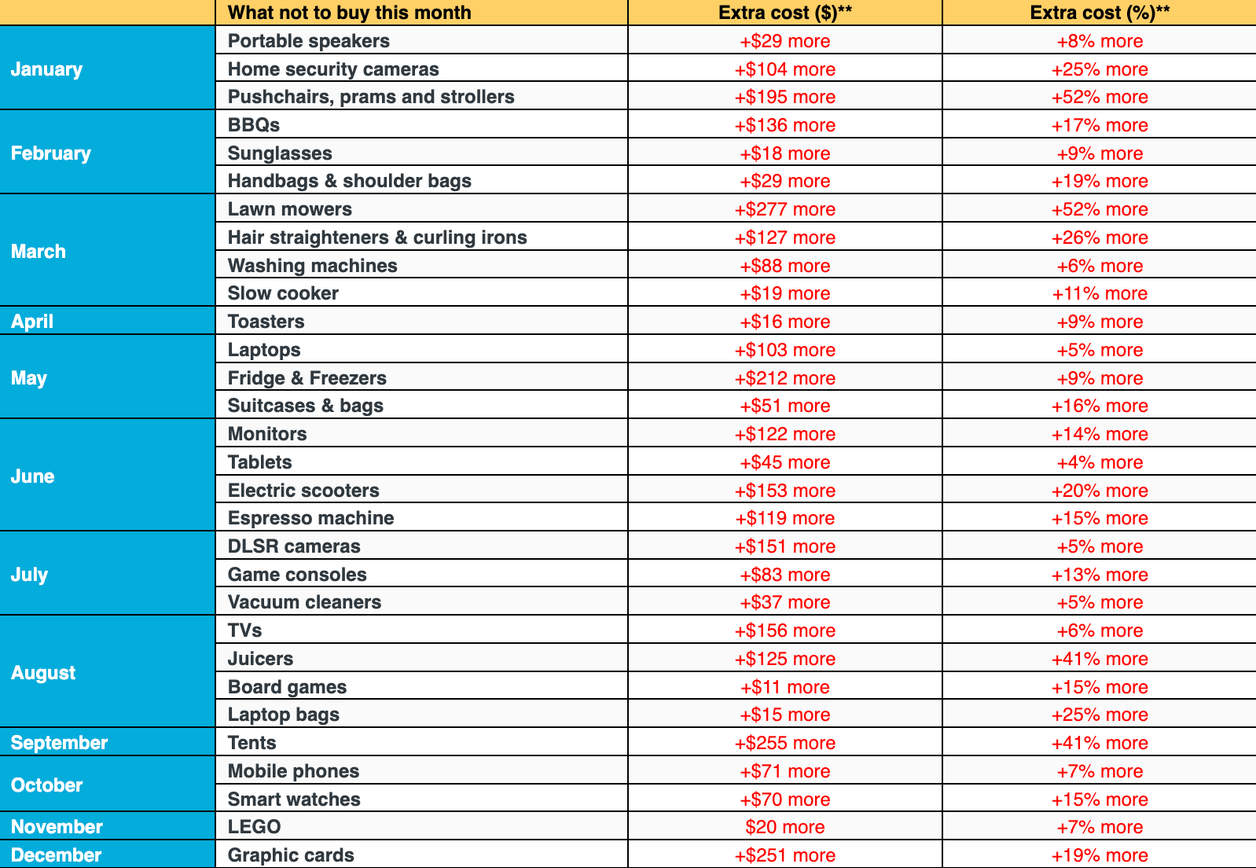

PriceSpy Guide – The worst time to buy

“Whilst people’s reasons for shopping will differ, one thing will surely be the same - no-one wants to pay over the odds for a product if they can help it, especially when wider living costs are much more expensive, says Liisa.

“Knowledge is power and knowing the best time to buy will mean that people can make their money go further.”

Avoid seasonality to secure the best bargains

For those on a budget, PriceSpy’s data demonstrates how buying products slightly out of season can deliver big savings. For example, putting off the purchase of a new BBQ until May can save a staggering $258 (48 per cent) compared to the average annual price.

Similarly, PriceSpy’s data demonstrates the premium consumers may pay by buying a product when it’s most in-demand. Buying a BBQ in February in the heat of summer, for instance, could end up costing an extra $136 (17 per cent) compared to the annual average price.

And overall, the difference between buying a BBQ when average costs are at their highest (February) versus when average costs are at their lowest (May), offers a sizeable saving of $394.

Liisa concludes: "Some of the price increases we see across the year may be driven by supply and demand. For example, when consumers' needs for certain goods are naturally higher, like BBQs in the summer, they can expect retailers to sell such goods at higher price points.

“Ultimately, if consumers do not have to buy something immediately, taking time to make a purchase and keeping a close eye on what price points are doing, will help deliver the best result and potentially help save thousands of dollars in the long run.

“Another great tip is to also set up a free price alert on a service such as PriceSpy. Price alerts help consumers monitor the price of the products they are looking to buy, and they are automatically sent notifications to advise them when the time and price is right.”

-ends-

PriceSpy is a comprehensive price and product comparison service used by millions of consumers every month. It helps consumers find, discover, research and compare products.

Read more